Airline financial management is a multifaceted challenging task. Most of the airlines rely on the conventional MS Excel to generate various financial statements. Selecting and implementing the right solution for cash management is the key challenge the airlines often face. Today, many airlines are availing Treasury Management System (TMS) that provides finance handling solutions.

In this chapter, we will discuss briefly how airlines manage their costs and revenues.

Airline Costs

Any airline needs to deal with the following types of costs −

Startup Costs

- Capital investment

- Inventory costs

Operating Costs

- Fuel cost

- Labor cost

- Employee cost

Depreciation Costs

- Aircraft spares cost

Airline Cash Management

Cash management is tackled with the help of cash forecasting or cash budgeting. Forecasting is done either Short Term, or Long Term.

Purpose of Airline Cash Forecasting

Short-tern cash forecasting is used to accomplish the following −

- Determine operating cash requirements.

- Anticipate the need for short-term cash requirements.

- Invest any surplus cash wisely.

- Maintain cordial relations with banking partners.

- Long-term detailed cash forecasting is used to appraise proposed projects that require working capital and avail loans whenever required.

Airline Cash Forecasting Methods

The following are the different types of forecasting methods −

- Casual Forecasting − It is derived from analyzing the statistical relationship between dependent variable against independent variable. For example, analyzing trends.

- Trend Forecasting − The changes of dependent variable are judged with respect to time. This helps in anticipating time-related changes.

- Cyclical Variations − These are the changes in cash flow due to business cycles.

- Seasonal Variations − These are the changes in cash flow due to a specific time period in the year.

- Irregular Variations − These are the changes in cash flow due to erratic events such as strikes, wars, price wars, bankruptcies, or any other disturbance.

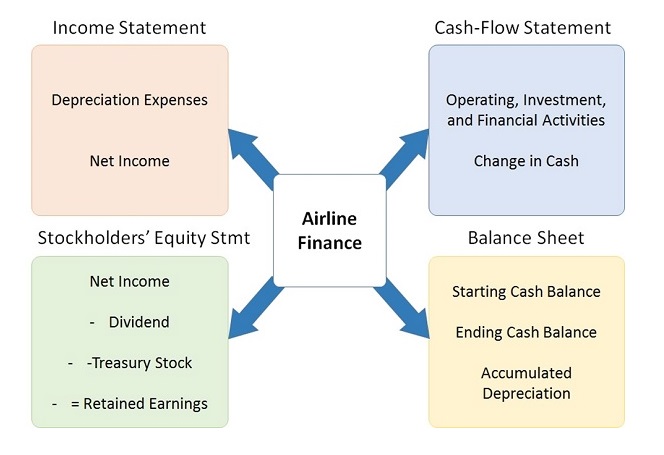

Airline Finance − Overview

The following are the four basic factors in airline finance management −

- Income Statement − It is a report that shows business managers and investors whether the airline made or lost money during the specific period.

- Cash Flow Statement − It provides information on cash receipts and payments, and the net change in cash due to operating, investing, and financing activities of an airline during the period.

- Stockholders’ Equity Statement − It is a record of the current equity stake held by the airline’s investors.

- Balance Sheet − It gives an idea about the financial position of the airline at a given point of time. It reflects what the airline owns as well as how much it owes.

Fuel and Currency Hedging

Airlines are extremely exposed to the changes in aviation fuel or jet fuel costs. A slightest change in the fuel prices can affect the airline business finance and operations. To deal with fuel price changes, the airlines use a tool named Fuel Hedging.

What is Fuel Hedging?

It is a contract that the airlines use to protect themselves from the changes and rise in fuel rates. The cost of fuel hedging depends on the forecasted price of fuel. The airlines enter into hedging contracts with fuel companies to establish a fixed price of the fuel. In future, if the fuel price increases than their contracted price, the airline is forced to pay the contracted price. If the price of fuel decreases than the current fuel price, then the airline receives the price difference from the fuel company.

Who provides fuel hedging service?

The fuel management companies, oil companies, and financial service companies provide fuel hedging service to the airlines. For example, World Fuel Service, British Petroleum, Morgan Stanley, and BNP Paribas.

Airline Revenues

With fierce competition in the aviation industry, the airlines come up with ideas of generating revenues in various ways. They study the customers and their needs, the competitors, reduce the airfare to attract new customers and keep the existing ones loyal. They also generate revenue from ancillary products and services.

Airline Taxes and Fees

Apart from the ticket price, they are the charges for fuel surcharge and service tax.

À la Carte Pricing Policy

It is a new pricing approach to let the customer choose the ancillary product or service and pay for it. For example, buying meals, snacks, and drinks on board that was traditionally part of the ticket. Also, the Low Cost Airlines offer their customer priority boarding or to select the seat of their choice and pay for it.

Add-on Services for Travel

The ancillary services such as pick-up and drop-off services to and fro from the customer’s residence and ticket bookings for special events at destination are offered as a part of ticket booking.

On-board Sale

It means the sale of duty-free items such as jewelry, liquor, tobacco, electronic gadgets, and perfumes. The airlines have come up with a wide range of electronic items, kitchen items, travel items, and gift items for sale on board. It is also extended to discount cards, credit cards, and direct marketing catalogues.

Advertising Sales

Conventionally, airlines only advertised themselves through their magazines distributed in-flight. Now, through their own airline websites they generate considerable opportunities for advertising revenue. The website is a gateway to reach the potential air travelers via hotels, car-rental companies, and travel-insurance providers where they look for travel options.

Comments

Post a Comment